2026 Student Loan Survival Guide: Navigate SAVE Blockage, IBR Switch & Critical Deadlines

Key Terms in This Article

- IBR

- Income-Based Repayment. A federal student loan repayment plan created by Congress that is shielded from many legal challenges.

- SAVE

- Saving on a Valuable Education. An IDR plan blocked by federal courts in 2024.

- PSLF

- Public Service Loan Forgiveness. A program that forgives federal student loans for borrowers who work in public service.

Navigating the new student loan landscape can be overwhelming. This guide is your map.

Table of Contents

What’s Inside This Guide:

1. The New Reality: Acknowledging the Chaos

- 1.1. The Judicial Blockade: The End of SAVE

- 1.2. The Legislative Overhaul: The “One Big Beautiful Bill Act”

2. Your New Playbook: Deconstructing the “Big Beautiful Bill”

- 2.1 The New Borrowing Limits Explained

- 2.2 The Repayment Assistance Plan (RAP): A Deep Dive

- 2.3 The End of an Era: July 1, 2028 Sunset Date

3. Strategic Lifelines: Your Action Plan

- 3.1 Why IBR is Now Your Most Important Lifeline

- 3.2 The Consolidation Crossroads

- 3.3 Special Alert for Parent PLUS Borrowers

4. Avoiding the Traps: Self-Defense Against Servicers and Private Loans

- 4.1 The Private Loan Trap

- 4.2 Your Servicer is Not Your Friend

5. Conclusion: Take Control Now

Your urgent action plan with critical deadlines

Frequently Asked Questions

Quick Answers

What changed with student loans in 2026? The SAVE plan was blocked by federal courts in mid-2024, and new legislation (H.R. 1, the “One Big Beautiful Bill Act”) was signed July 4, 2025. This eliminated most Income-Driven Repayment options effective July 1, 2028, and created strict consolidation deadlines.

Who is affected?

- Approximately 7-8 million borrowers previously enrolled in SAVE (now in administrative forbearance)

- Anyone with Parent PLUS loans

- All borrowers taking out new loans after July 1, 2026

What should you do now?

- Apply for IBR immediately - Even though you’re in SAVE forbearance, start your IBR application now. Processing takes 4-8 weeks, and the sooner you apply, the sooner you can make qualifying payments toward forgiveness.

- Download your loan history from StudentAid.gov today - This is your proof of payment counts if servicers make errors.

- Complete consolidation before July 1, 2026 (if needed) - After this date, you permanently lose access to IBR, PAYE, and other grandfathered plans.

- Parent PLUS borrowers: Start double consolidation NOW - Processing typically takes 4-6 weeks per phase. The Department recommends applying by April 1, 2026 to ensure completion before the July 1, 2026 deadline.

Critical Deadlines:

-

August 1, 2025: Interest resumed for SAVE borrowers in forbearance

-

April 1, 2026: Recommended application deadline for Parent PLUS double consolidation (per Department of Education guidance)

-

July 1, 2026: Hard deadline. Any consolidation completed on or after this date permanently locks you out of legacy plans (IBR, PAYE, ICR)

-

July 1, 2028: SAVE, PAYE, and ICR plans sunset completely. Borrowers on these plans will be automatically transitioned to RAP if they do not choose a plan before then.

1. The New Reality. Acknowledging the Chaos

If you feel like the rules of the game have been changed on you halfway through, you’re not wrong. You are certainly not alone.

For millions of student loan borrowers across the country, the past few years have felt less like a carefully regulated financial environment and more like a chaotic political battlefield. You have faced constant whiplash: promised relief, court battles, administrative pauses, sudden deadlines, and, most recently, the demise of the very repayment plan designed to offer you a manageable path forward. It is frustrating, confusing, and completely undermines the fundamental promise that responsible borrowing and repayment can lead to financial stability.

This constant state of upheaval, driven by partisan lawsuits and sweeping new legislation, has thrown the entire federal student loan system into what experts describe as untenable chaos. Advisors who have spent years guiding borrowers are finding much of their long-standing counsel contradicted by rapid political and judicial “ping-pong”.

Your feelings of anxiety and betrayal are entirely justified. But know this: The chaos is the system’s fault, not yours. This article is your new map. It is a clear, actionable playbook designed to cut through the confusion and help you regain control over your debt.

The Big Picture: What Just Happened?

Key Timeline of Events:

- June 2024: Federal courts issue initial injunctions against the SAVE plan.

- July 4, 2025: The “One Big Beautiful Bill Act” is signed into law, creating new rules and plans.

- August 1, 2025: Interest resumes for millions of borrowers stuck in SAVE forbearance.

To understand where we are now, we must first look at the whirlwind of legal decisions and legislative actions that occurred over the last year. The rapid, two-pronged attack on the student loan safety net, one judicial, one legislative, created the “new reality” you are now facing.

1.1. The Judicial Blockade: The End of SAVE

The Biden administration’s Saving on a Valuable Education (SAVE) plan was intended to be the most generous Income-Driven Repayment (IDR) plan ever created, offering significantly lowered monthly payments (often $0 for low-income borrowers) and even loan forgiveness after as few as 10 years for some borrowers. More than 7 million people had enrolled in the plan, relying on its promises of stability.

However, the SAVE plan became the target of intense legal challenges led by several Republican-led states. These states argued that the Department of Education was overstepping its statutory authority by creating such a broad and costly loan forgiveness program. The courts ultimately agreed with this highly technical argument:

- Initial Injunctions: In June 2024, federal judges in Missouri and Kansas issued separate injunctions initially blocking parts of the SAVE plan, specifically targeting its loan forgiveness provisions.

- The Hybrid Rule Failure: Despite the initial injunction, the Department of Education (ED) attempted to continue forgiveness processing using a “hybrid rule,” which combined the low payments of SAVE with the longer forgiveness timelines of the preceding REPAYE plan. The court swiftly deemed this maneuver a nullity, arguing it circumvented the injunction.

- The Full Block: The U.S. Court of Appeals for the Eighth Circuit intervened, upholding the initial injunction and ordering the entire SAVE rule to be blocked. The core rationale hinged on the major questions doctrine which holds that agencies cannot undertake actions of “vast economic and political significance,” such as forgiving billions in debt, without clear, explicit congressional authorization.

- The Financial Consequences: In response to the judicial orders blocking SAVE, ED placed the millions of enrolled borrowers into a forbearance period. Crucially, while this forbearance was initially interest-free, the Trump administration recently announced that, starting August 1, 2025, interest charges will resume for these approximately 7-8 million borrowers, imposing potentially billions of dollars in new, unnecessary costs on working families who are trapped in limbo through no fault of their own. This interest-accruing period will not count toward Public Service Loan Forgiveness (PSLF) or IDR forgiveness.

1.2. The Legislative Overhaul: The “One Big Beautiful Bill Act”

While the SAVE plan was being dismantled in the courts, Congress advanced sweeping new legislation through a hyper-partisan process that relies on a simple majority vote: budget reconciliation.

- The Process: Reconciliation is a powerful legislative tool intended to quickly align tax and mandatory spending changes with congressional budget targets, effectively bypassing the Senate filibuster.

- The Bill: This process led to the passage of H.R. 1, officially titled the “One Big Beautiful Bill Act” (OBBBA). The bill passed the House (215–214) and the Senate (51–50, broken by Vice President, JD Vance). It was signed into law on July 4, 2025.

- Student Loan Impact: The legislation aimed to radically streamline the repayment system, eliminating the maze of options and curbing forgiveness perceived as too generous. The law specifically sought to repeal the SAVE plan. It codified a new plan called the Repayment Assistance Program (RAP).

- The Grandfather Clause (A Temporary Reprieve): Despite the stated goal of simplifying repayment, the final law offered a crucial, but temporary, window of protection for current borrowers. It preserved access to existing plans like PAYE and Income-Contingent Repayment (ICR), and even the SAVE plan, until July 1, 2028, provided that a borrower had loans outstanding before July 1, 2026. After that 2028 sunset date, borrowers who don’t actively switch plans will be defaulted into the new, less generous RAP plan.

Regaining Control in the Eye of the Storm (Your Next Step)

The result of these simultaneous legal and political actions is a student loan landscape that defies simple explanation. Millions of borrowers who were enrolled in SAVE are now stuck in an interest-accruing forbearance, trying to navigate a system that is fundamentally changing beneath their feet.

The critical first step in regaining control is translating the confusing new legislation and court risk into concrete numbers for your specific situation. You cannot rely on promises that are constantly being litigated or repealed. You need to know exactly how much you owe, how different plans affect your payoff date, and what risk remains.

We built the Payoff Climb Calculator specifically for this unpredictable environment. It is the single most powerful tool you have right now to model your options in the wake of the SAVE injunction and the passage of H.R. 1, the “One Big Beautiful Bill Act.”

Don’t rely on hope, rely on math. Take back control of your financial future today by plugging your numbers into the calculator now.

2. Your New Playbook: Deconstructing the “Big Beautiful Bill”

The “One Big Beautiful Bill Act” (OBBBA), signed into law on July 4, 2025, is a massive piece of legislation that fundamentally redesigns the mechanics of federal student aid. For current borrowers, it creates deadlines and forces transitions. For future borrowers, it establishes hard limits on how much they can ever borrow.

This section provides the essential facts you need to understand the new system, the new borrowing limitations, and the mandatory new repayment mechanism, the Repayment Assistance Plan (RAP).

2.1. The New Borrowing Limits Explained

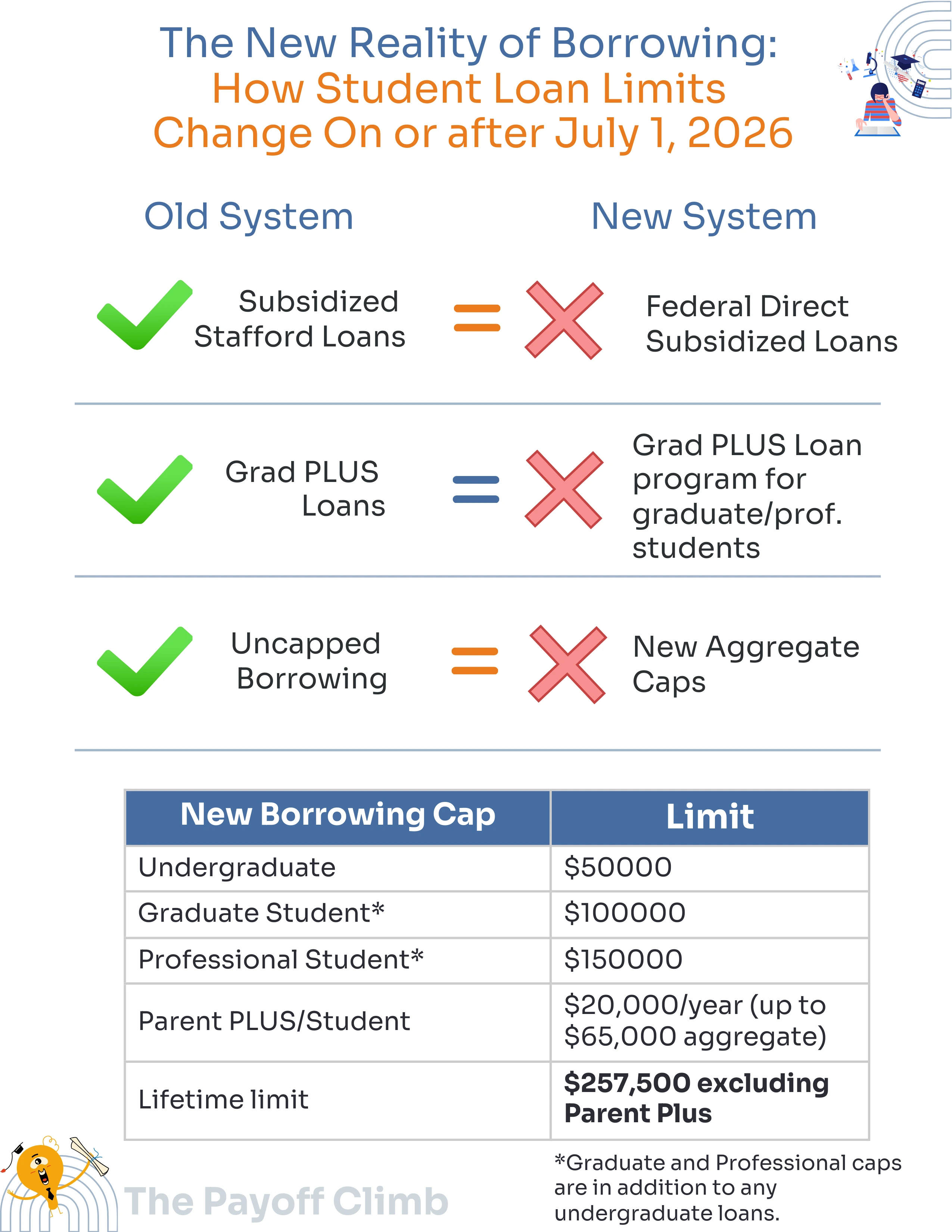

The most dramatic structural change brought by H.R. 1 affects loans disbursed for academic periods beginning on or after July 1, 2026. If you have loans originated on or after this date, you will be subject to strict new annual and aggregate lifetime caps.

The core message here is simplicity through restriction: the bill eliminates certain generous loan types and sets definitive financial boundaries.

Key Borrowing Limits Effective July 1, 2026:

- Subsidized Loans Unchanged for Undergraduates: Federal Direct Subsidized Stafford loans for undergraduate students remain available with existing limits unchanged. However, subsidized loans will no longer be available for graduate students (they were already limited to undergraduates before this legislation).

- Termination of Grad PLUS Loans: The Federal Direct PLUS Loan program for graduate and professional students (Grad PLUS) is terminated. This is significant because Grad PLUS loans previously allowed students to borrow up to the full cost of attendance, essentially providing uncapped lending for professional degrees.

- New Aggregate Caps on Direct Unsubsidized Loans:

- Undergraduate Cap: The maximum aggregate amount an undergraduate student may borrow is set at $50,000.

- Graduate Student Cap: For graduate students (non-professional), the lifetime limit for Direct Unsubsidized Loans is $100,000 (in addition to the undergraduate amount) or $20,500 annually.

- Professional Student Cap: For students pursuing a professional degree, the lifetime limit is $200,000 (in addition to the undergraduate amount) or $50,000 annually.

- Parent PLUS Loan Restriction: The legislation places severe limits on Parent PLUS loans. Beginning July 1, 2026, the maximum annual amount a parent can borrow on behalf of a dependent student is capped at $20,000. Furthermore, the total maximum aggregate amount a parent may borrow per dependent student is capped at $65,000.

- The Ultimate Lifetime Cap: The total maximum aggregate amount of all loans made, insured, or guaranteed under federal student aid programs that a student may borrow (excluding Parent PLUS loans taken out by the parent) is set at $257,500.

The changes are dramatic. This infographic breaks down the new reality for borrowers, showing exactly how the rules are changing for loans disbursed on or after July 1, 2026.

Scenario: The Future Medical Student (Starting 2027)

Imagine a student entering college in Fall 2027 who plans to attend medical school (a professional program).

| Loan Category | Old System (Pre-July 2026) | New System (Post-July 2026) |

|---|---|---|

| Undergraduate Loans | Subsidized & Unsubsidized (existing limits) | Subsidized & Unsubsidized remain. Max $50,000 aggregate limit |

| Graduate/Professional Loans | Unsubsidized + unlimited Grad PLUS | Max $200,000 (Unsubsidized only) |

| Total Federal Debt Limit | Effectively uncapped | Effectively $257,500 |

For new students, this cap on borrowing, coupled with the elimination of Grad PLUS, means institutions face accountability pressure and students will need alternate financing methods, likely forcing them toward the private loan market for the first time in certain high-cost programs.

2.2. The Repayment Assistance Plan (RAP): A Deep Dive

The legislation repeals the SAVE plan, which the Committee Print characterized as costing taxpayers $220 billion and turning the program into “backdoor mechanism for providing ‘free’ college”. It replaces the complex suite of IDR plans with just one: the Repayment Assistance Plan (RAP).

RAP is the new income-driven safety net designed to help troubled borrowers repay loans without ballooning balances, but with a stricter, mandatory repayment structure.

RAP Eligibility and Application

RAP applies to all federal Direct Loans disbursed on or after July 1, 2026. If you are a new borrower (taking out a loan on or after this date), you will have two repayment choices only: a fixed standard plan or RAP.

Crucially, certain loans are excluded from RAP:

Parent PLUS Loans (and Consolidation Loans resulting from them) are defined as “excepted loans” and are not eligible for RAP. Parent borrowers who have these types of loans outstanding on or after July 1, 2026, must repay them under the fixed standard repayment plan.

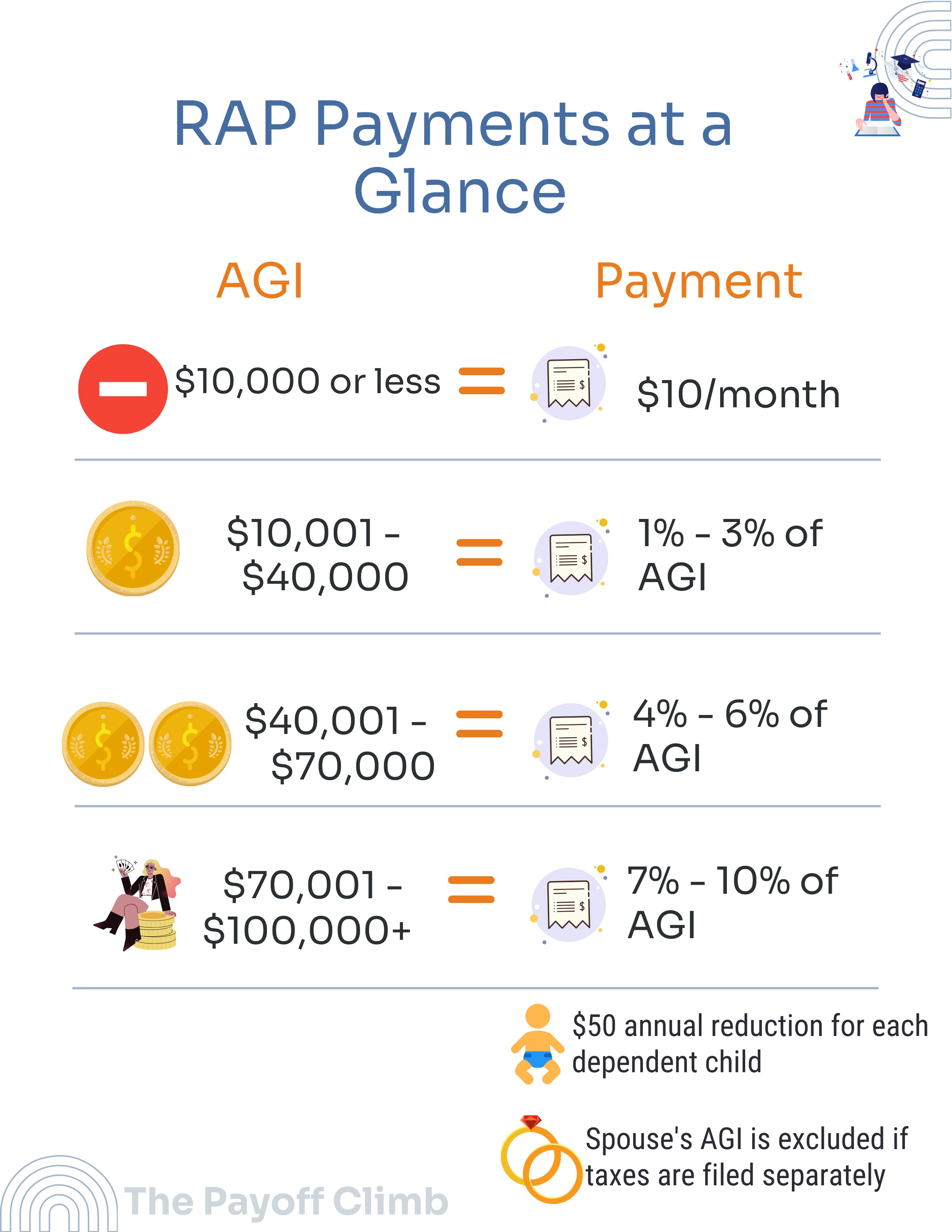

The Payment Calculation Workshop (Based on AGI)

Under RAP, your monthly payment is calculated based on your total Adjusted Gross Income (AGI), scaled upward in tiers. This differs significantly from previous IDR plans that used a percentage of “discretionary income” above a fixed poverty line threshold.

- Marital Status: If married, your spouse’s AGI is excluded if you file taxes separately.

- Dependent Deduction: Your monthly calculated payment is reduced by $50 for each dependent child.

The following table details the tiered calculation based on your AGI:

| AGI Range (Annual) | Annual Payment Base Calculation |

|---|---|

| $10,000 or less | $120 (Minimum monthly payment of $10) |

| $10,001 – $20,000 | 1% of AGI |

| $20,001 – $30,000 | 2% of AGI |

| $30,001 – $40,000 | 3% of AGI |

| $40,001 – $50,000 | 4% of AGI |

| $50,001 – $60,000 | 5% of AGI |

| $60,001 – $70,000 | 6% of AGI |

| $70,001 – $80,000 | 7% of AGI |

| $80,001 – $90,000 | 8% of AGI |

| $90,001 – $100,000 | 9% of AGI |

| Over $100,000 | 10% of AGI |

Example of the AGI Cliff Effect:

- A borrower with an AGI of $20,000 pays 1% of AGI, totaling $200 per year ($16.67/month).

- A borrower with an AGI of $20,001 pays 2% of AGI, totaling $400.02 per year ($33.34/month).

This tiered structure creates sharp increases in monthly payments based on tiny increases in income. This “cliff effect” requires diligent financial planning as your income grows. You must know exactly where you fall in these tiers.

Don’t manage this risk blindly. Translate the new RAP structure into concrete monthly payment amounts for your specific financial profile. Use the Payoff Climb Calculator now to model your expected payments under RAP and compare them to the grandfathered options still available to you.

The new Repayment Assistance Plan (RAP) uses a tiered system based on your income. We’ve simplified the complex official table into this at-a-glance guide to help you find your rate and understand the key deductions.

Pros and Cons of the Repayment Assistance Plan (RAP)

| Feature | RAP (Repayment Assistance Plan) | Analysis (Pro/Con) |

|---|---|---|

| Minimum Payment | Must pay at least $10 per month, regardless of how low calculated income is. | Con: Unlike previous plans (SAVE, REPAYE, IBR, PAYE) which often allowed $0 payments for low-income borrowers, the floor is now $10. |

| Interest Subsidy (Balance Assistance) | If your on-time monthly payment does not cover the full amount of accrued interest, the unpaid interest shall not be charged to the borrower. | Pro: This prevents the loan balance from growing due to negative amortization, addressing a massive problem in older IDR plans. |

| Principal Matching (The $50 Rule) | If your monthly payment reduces the principal by less than $50, the government reduces the total outstanding principal by the lesser of $50 or the difference between your payment and the amount applied to principal. | Pro: This ensures the principal balance is reduced by at least $50 each month if you make an on-time payment, providing concrete progress for struggling borrowers. |

| Loan Forgiveness Term | The remaining balance is canceled after 360 qualifying monthly payments (30 years). Payments under various prior IDR and Standard plans can count toward this 360-month total. | Con: This 30-year forgiveness period is significantly longer than the 20- or 25-year limits provided under many older IDR plans, including SAVE and PAYE. |

| PSLF Eligibility | Payments made under RAP count as qualifying payments for Public Service Loan Forgiveness (PSLF). | Pro: This preserves access to the 10-year PSLF program for new borrowers in public service. |

2.3. The End of an Era

For current borrowers, the key takeaway is that the “Big Beautiful Bill” codifies the termination of the most generous repayment options and establishes a clear, non-negotiable sunset date.

The Hard Deadline: July 1, 2028

The new law terminates the authority for several existing Income-Contingent Repayment (ICR) plans, including SAVE and PAYE. This means access to these plans for most current borrowers will end on a defined date:

- All current ICR, PAYE, and SAVE plans will be sunsetted on July 1, 2028.

You may continue to utilize ICR and PAYE until this date, but the clock is ticking.

The Consequences of Doing Nothing

This deadline is an administrative cliff. If you are currently enrolled in SAVE (or PAYE or ICR) and take no action by July 1, 2028, the Secretary of Education is mandated to enroll your loans into one of two default options:

- Repayment Assistance Plan (RAP): If your loans are otherwise eligible for RAP (i.e., they are not Parent PLUS loans or consolidation loans derived from Parent PLUS).

- Income-Based Repayment (IBR) Plan: If your loans are generally eligible for IDR but are explicitly excluded from RAP (such as consolidated Parent PLUS loans).

This means inaction removes your flexibility and forces you into a plan. For consolidated Parent PLUS borrowers, ensuring you remain on ICR, PAYE, or SAVE at some point between July 4, 2025, and June 30, 2028, is essential to retaining access to the IBR plan after the 2028 sunset.

For borrowers with loans outstanding before July 1, 2026, you retain access to: Old IBR, New IBR, Graduated Repayment, Extended Repayment, and the 10-Year Standard Plan even after the 2028 sunset.

If you are a borrower who takes out a loan on or after July 1, 2026, and fails to select a repayment plan, you will automatically be placed into the new standardized repayment plan. This fixed payment plan determines the term length based on your total outstanding principal, ranging from 10 years (for balances under $25,000) up to 25 years (for balances over $100,000). This fixed plan does not adjust to your income, meaning sudden, unaffordable monthly bills are likely if you are struggling financially.

This is the part where we stop analyzing the legislative and judicial history and focus only on what you must do now.

The primary strategic challenge is clear: the most generous repayment plans (SAVE, PAYE, ICR) are either legally challenged, permanently enjoined, or set for repeal by 2028. We need a stable, long-term harbor that is authorized directly by Congress and recognized as legitimate across all future administrations.

3. Strategic Lifelines: Your Action Plan

3.1: Why IBR is Now Your Most Important Lifeline

With the Saving on a Valuable Education (SAVE) plan currently blocked by court injunctions across the country, and with the forgiveness components of all other Income-Contingent Repayment (ICR) plans (including PAYE and REPAYE) also called into question by those same judicial rulings, we must shift our focus to the most legally stable and enduring safety net: the Income-Based Repayment (IBR) Plan.

The IBR plan is your most important lifeline because, unlike the other plans created by regulation (ICR, PAYE, REPAYE, SAVE), IBR was created directly by Congress. The underlying law authorizing IBR specifically mandated that the Secretary of Education shall repay or cancel any outstanding balance once a borrower meets the payment requirements. This key difference shields IBR’s forgiveness promise from the primary legal attack that destroyed SAVE, the argument that the Department of Education exceeded its statutory authority.

Furthermore, the “One Big Beautiful Bill Act” (H.R. 1) provides IBR permanent protection. For current borrowers (those without new loans after July 1, 2026), Old IBR and New IBR remain available even after the 2028 sunset that kills PAYE and ICR. In fact, borrowers on the sunsetting plans (ICR, PAYE, SAVE) who fail to choose a new path by July 1, 2028, will automatically be transitioned into IBR or the new RAP plan, depending on their eligibility.

CRITICAL UPDATE: The End of the Partial Financial Hardship Requirement

Historically, all versions of IBR required you to prove a “Partial Financial Hardship” (PFH) to enroll and remain eligible. This test meant your calculated IDR payment had to be less than your payment would be under the standard 10-year plan. If your income rose too high, you could lose PFH and be forced into higher payments.

H.R. 1 eliminates this obstacle. Effective July 4, 2025, the Partial Financial Hardship requirement for IBR is eliminated. Although official implementation may take months, this change means IBR will soon be available to all eligible borrowers, regardless of income, making it a powerful defensive strategy against the current instability.

Comparing Your Two IBR Options

There are two versions of IBR based on when you took out your first loan:

| Plan Version | Eligibility Requirement | Payment Calculation | Forgiveness Timeline |

|---|---|---|---|

| Old IBR | You are NOT a new borrower on or after July 1, 2014. | 15% of your discretionary income (AGI minus 150% of the poverty line). | 25 Years (300 qualifying payments). |

| New IBR | You ARE a new borrower on or after July 1, 2014 (meaning all your federal loans were disbursed on or after this date). | 10% of your discretionary income (AGI minus 150% of the poverty line). | 20 Years (240 qualifying payments). |

Action Item: If you qualify for New IBR, it is the clear choice, offering both a lower payment (10% vs. 15%) and a faster forgiveness timeline (20 years vs. 25 years).

Ready to Secure Your IBR Lifeline?

Understanding that IBR is your safest harbor is the first step. The next step is navigating the enrollment process correctly to ensure you lock in these benefits without delay. Our step-by-step ‘IBR Lifeline’ Enrollment Guide walks you through the entire process, from determining your eligibility for Old vs. New IBR to completing the application correctly amid current servicer backlogs.

Download the IBR Enrollment Guide Now

3.2. The Consolidation Crossroads

You are standing at a critical juncture regarding consolidation. While consolidation can offer the benefits of a single payment, a potentially lower monthly bill by extending the repayment term, and access to repayment or forgiveness programs for certain older loans (like FFEL or Perkins loans), it must be executed with precision before the Congressional deadline.

The Hard Deadline: July 1, 2026

The most urgent threat to your long-term financial plan is the legislative hard stop set by H.R. 1.

If you take out a new loan or consolidate loans (even existing ones) on or after July 1, 2026, you permanently lose access to all the original, traditional repayment plans, including IBR, PAYE, ICR, Graduated, and Extended plans, on ALL your loans, new and old.

Your entire portfolio will be limited solely to the new, less generous options: the Repayment Assistance Plan (RAP) or the new tiered Standard Plan.

This rule applies universally. There are zero ways to maintain access to the old plans if you borrow or consolidate on or after July 1, 2026.

| IF you consolidate or borrow… | THEN the consequence is… |

|---|---|

| Before July 1, 2026 | You retain access to all grandfathered plans (Old IBR, New IBR, ICR, PAYE) until the July 1, 2028 sunset (or indefinitely for IBR). This is your safe zone. |

| On or after July 1, 2026 | You are permanently locked out of all prior repayment plans (IBR, PAYE, ICR, Extended, Graduated) for all your loans. You will be restricted to the RAP plan or the new Standard Plan. |

Navigating Repayment Counts During Consolidation

Historically, consolidation would reset any progress made toward Income-Driven Repayment (IDR) or Public Service Loan Forgiveness (PSLF) to zero. The Department of Education offered a temporary measure to counter this risk (the one-time account adjustment), but the deadline to consolidate and receive the highest IDR/PSLF payment count expired on June 30, 2024.

If you consolidate today (after June 30, 2024), you must be aware of the following reality:

- You WILL lose credit initially: When the new Direct Consolidation Loan is created, your payment count will temporarily reset to zero.

- Your count will be restored to a weighted average: Under current rules, the consolidation loan will ultimately be assigned a weighted average of the qualifying payments made on the underlying loans.

- Example: If you have $50,000 in loans with 50 qualifying payments and $25,000 in newer loans with 100 qualifying payments, your new consolidation loan will have a weighted average count of 67 payments.

- PSLF Payments: For PSLF, the weighted average is calculated only for eligible payments made on Direct Loans.

Warning: Consolidation can still result in the capitalization of unpaid interest (adding it to your principal balance), leading to a higher overall loan cost.

3.3. Special Alert for Parent PLUS Borrowers

If you hold federal Parent PLUS (PP) loans, your strategic path is both more complicated and more urgent. You are faced with the immediate problem that PP loans are legally treated as “excepted loans” and are generally limited to the least favorable IDR plan, the Income-Contingent Repayment (ICR) plan, even after a single consolidation. ICR payments are often unaffordable, calculated at 20% of discretionary income using a low exclusion threshold (100% of the poverty line).

Crucially, Parent PLUS borrowers are excluded from the new Repayment Assistance Plan (RAP). If you do nothing before the July 1, 2026 deadline, your consolidated PP loans may be forced back onto the standard fixed plan or ICR, leaving you with unaffordable payments.

The only way to access the more affordable IDR options like IBR or PAYE is through a complex administrative maneuver known as the double consolidation loophole. While the Biden Administration previously planned to close this loophole in July 2025, that deadline is currently suspended due to court injunctions. However, the legislative threat remains: you must complete this process before July 1, 2026, to preserve access to IBR long-term.

Don’t Navigate the Loophole Alone. Get the Toolkit.

The double consolidation process is your single best path to affordable payments, but it is complex, and mistakes can be costly, potentially locking you out of IBR forever.

We’ve created The Double Consolidation Loophole Toolkit for this exact reason. It’s a complete, step-by-step visual roadmap with checklists, form guides, and troubleshooting tips to guide you through all 4-6 weeks of the process, ensuring you get it right before the absolute July 1, 2026 deadline.

Get the Double Consolidation Toolkit Here

Step-by-Step Guide to Double Consolidation

The goal of this process is to consolidate your Parent PLUS loans twice, obscuring their original loan type so the final consolidated loan is classified as a standard Direct Consolidation Loan eligible for IBR and PAYE.

Total Time Required: 3-4 weeks (Do NOT wait). Loan servicers are processing these applications normally, but the lengthy duration means starting immediately is crucial.

Phase 1: Splitting the Loans (The Paperwork Grind)

The vast majority of mistakes happen in Phase 1, usually due to paperwork errors or trying to submit both applications online.

- Divide Your Loans: Divide all your Parent PLUS (and any other eligible federal) loans into at least two separate, distinct groups, Group A and Group B. Each group must contain at least one loan. (If you only have one PP loan, this strategy is unavailable to you unless you take out a small new eligible loan, which may now be too late to gain full benefit).

- Application 1 (Paper): Complete a paper Direct Consolidation Loan Application and Promissory Note (Note) for Group A. You must include the loan details (code, holder name, account number, payoff amount).

- Application 2 (Paper): Complete a separate paper application for Group B.

- Use Different Servicers: Submit Application 1 to one loan servicer (Servicer 1) and Application 2 to a different loan servicer (Servicer 2). This is mandatory to prevent the applications from being merged into a single loan.

- Select Placeholder Plan: For both initial applications, include a Repayment Plan Request form selecting the Standard Repayment Plan as a placeholder to prevent denial for failure to specify a plan.

- Wait and Confirm: Mail both applications via certified mail and wait 3-4 weeks for processing. You must confirm on the federal system (StudentAid.gov) that both initial consolidations have been funded and are showing up as two separate Direct Consolidation Loans.

Phase 2: Final Consolidation (Unlocking IDR)

- Application 3 (Online): Once the two new consolidation loans (from Phase 1) are verified, submit your final Direct Consolidation Loan application online. You will select both new consolidation loans for this final consolidation.

- Choose a New Servicer: Select a third, different loan servicer (Servicer 3) for the final consolidation, as the first two servicers know the origin of the loan. If you are pursuing Public Service Loan Forgiveness (PSLF), the Department of Education manages PSLF through StudentAid portal.

- Select Your Lifeline IDR Plan: On this final application, select the Income-Driven Repayment plan you want to use, typically IBR (or PAYE, if you are eligible based on your borrowing history).

- Risk Mitigation: Apply for ICR. While waiting for the final consolidation to finalize (3-4 weeks), proactively apply for the ICR plan on your two Phase 1 loans. This is a strategic defensive move: if Congress or a future administration terminates all expanded IDR access, enrolling in ICR now creates a historical record that may grandfather you into future repayment plans.

By completing this process, your new, singular Direct Consolidation Loan will be eligible for IBR (20- or 25-year forgiveness at 10% or 15% of discretionary income) and potentially PAYE (20-year forgiveness at 10% of discretionary income). This outcome often drastically lowers the Parent PLUS borrower’s monthly payment and accelerates the path toward eventual loan forgiveness.

Critical Timing Note: The Department of Education recommends submitting your final consolidation application by April 1, 2026 to allow adequate processing time before the July 1, 2026 deadline. While official processing estimates are 6-8 weeks per phase, some borrowers have experienced delays.

4. Avoiding the Traps: Self-Defense Against Servicers and Private Loans

The environment we find ourselves in demands diligence and self-defense. In the face of political and judicial volatility, you cannot trust the promises of the system, only your own records and vigilance.

This section provides the necessary warnings about the two primary pitfalls borrowers face right now: the tempting but dangerous private loan trap and the consistent administrative failures of federal loan servicers.

4.1. The Private Loan Trap

In the midst of chaos, a lower interest rate on a private loan can seem like a beacon of stability. You may have excellent credit now, or perhaps a private lender has offered you a seductive refinancing bonus. Do not fall for this trap without fully acknowledging the catastrophic loss of protection.

Private student loans, offered by private lenders, operate entirely outside the federal safety net. If you refinance your federal loans into a private loan, you irreversibly forfeit access to all federal loan benefits, flexible repayment options, and any forgiveness programs, whether existing (like IBR or PSLF) or future ones that may become available.

This forfeiture is the core risk because once financial distress hits, the private lending industry offers strikingly little reprieve:

- No Guaranteed Affordable Options: Unlike federal loans which provide Income-Driven Repayment (IDR) plans that cap payments based on your income (sometimes resulting in payments as low as $0), private loans are not required to offer affordable loan modification options. Borrowers routinely report being driven into default because private companies refuse to provide concrete, viable options to lower the monthly payment.

- The Temporary Fix Scam: When private lenders do offer assistance, it is often a temporary fix, usually a short-term forbearance lasting only a few months.

- Fees and Delays: Borrowers frequently complain that, even for this temporary relief, they must pay burdensome enrollment fees, sometimes up to $50 per loan, as a precondition for forbearance.

- Surprise Default: Consumers have reported processing delays for these temporary forbearances, which sometimes cause them to default before the short-term pause is even approved.

- The Default Cliff: If you default on a private loan (can happen in as little as three months compared to nine months for federal loans), the consequences are brutal. The entire outstanding balance may be immediately due in full. This damages your credit profile which can negatively affect your ability to pass employment background checks, obtain housing, and access other forms of credit for years.

- Co-signer Liability: Even if you are making on-time payments, some private loan agreements contain a clause that can put your loan into default if your co-signer passes away or files for bankruptcy.

- Unclear Communication: When clear information is not available on the lenders’ website, consumers report receiving conflicting or inaccurate information from multiple customer service representatives.

If your credit is stellar and your financial future is unshakably secure, refinancing to a private loan might net you a slightly lower interest rate, but you must realize you are surrendering all forms of protection for what is often an incremental saving.

Your Private Loan Offense

If you are already burdened with private student loans or if you have made the decision that private refinancing is necessary despite the risks, your goal is survival through rapid, aggressive debt elimination. Federal safety nets are off the table; the only leverage you have is speed.

Your focus must shift from long-term federal forgiveness strategies (which you sacrificed) to building a concrete plan to minimize interest paid.

Use the Payoff Climb Calculator to rigorously model an aggressive repayment schedule. Determine exactly how much faster you can eliminate the debt by allocating every spare dollar toward the highest-interest loan first. Because private lenders won’t offer you an affordable plan, you must create one yourself and hold yourself accountable to it.

If you’ve already refinanced your federal loans, you know the safety nets are gone. Forgiveness is off the table, and the lender’s playbook is rigged against you. Hope is not a strategy; aggressive debt elimination is.

Our comprehensive e-book, Surviving Private Loans: The Aggressive Debt Elimination Manual, teaches you how to shift from a defensive mindset to an attack mindset. Learn the principles of rapid payoff, the Debt Avalanche method, and how to build a “Debt Demolition Budget” to reclaim your financial freedom.

Download Your Aggressive Debt Elimination Manual

4.2. Your Servicer is Not Your Friend

The federal student loan servicers, the government’s contracted vendors, have historically been a source of significant error and confusion for borrowers. In the current climate, where court orders and massive legislative changes are happening simultaneously, the servicing system is in a state of untenable chaos.

You must approach every interaction with your servicer and every piece of mail you receive with extreme caution and skepticism. Servicers struggle to quickly adapt their complex database systems to sudden court rulings, leading to administrative errors that directly harm your path to forgiveness.

Recognizing and Countering Servicer Risks

- Administrative Backlog & Forbearance Risk: As a result of the SAVE injunction, millions of borrowers were placed into administrative forbearance. Despite ED’s efforts, the transition and recalculation process is complex, resulting in a large backlog of unprocessed IDR applications (over 1.6 million as of April 2025). If you apply for a new IDR plan (like IBR), your servicer may place you into a processing forbearance which generally does accrue interest if it lasts longer than 60 days, and this time does not count toward IDR or PSLF forgiveness.

- Payment Allocation Deception: Historically, servicers have faced enforcement actions for “inadequately disclosing its payment allocation methodologies” and allocating underpayments in a way that maximizes late fees. If you make extra payments, you must affirmatively tell your servicer to apply the excess funds directly to the principal of the loan you choose, typically the highest interest rate loan, to accelerate payoff and prevent maximizing total interest paid. If you do not provide this specific instruction, the money may be allocated in a way that serves the servicer’s financial interest, not yours.

- Inaccurate Records: Borrowers frequently report that their servicers’ payment tallies for PSLF or IDR do not match their personal records. You are the only person responsible for confirming your payment counts are accurate.

- Escalating Disputes: If your servicer denies a payment plan or miscalculates your forgiveness count, you must first contact the servicer directly to resolve it. If the issue persists, you should escalate the matter immediately by filing a formal complaint with the Consumer Financial Protection Bureau (CFPB) or Federal Student Aid (FSA) Ombudsman.

MUST-DO NOW: Create Your Personal Defense File

In this volatile environment, the only reliable source of truth about your loan history is the data you possess. You must maintain a meticulous, comprehensive digital file to protect your accumulated progress toward forgiveness.

The single most critical action you can take right now is to download your entire loan data history from the Department of Education’s website.

- Visit StudentAid.gov: Log into your account.

- Locate Your Loan Details: Navigate to the section showing your federal loan history.

- Download the .txt File: Find the option to download the raw data file (often referred to as the .txt file or loan data export). This file contains the most complete record of your loan origination, status changes, and servicer history.

Keep copies and snapshots of absolutely everything related to your debt: your work history if pursuing PSLF, records of your qualifying payments, every recertification application, and any communication with your servicer. If the system crashes, it is successfully challenged in court again, or your servicer makes a critical mistake, your downloaded file is the map that proves your progress.

Build Your Bulletproof Defense File in Under an Hour.

Knowing you need to keep records is one thing. Having an organized system is another. In a chaotic environment, your personal records are the only evidence that matters.

The Servicer Self-Defense File Kit provides everything you need to start today. This kit includes a complete document checklist, a communication log for tracking servicer calls, and sample dispute letters to protect your progress toward forgiveness from administrative errors.

Download the Self-Defense File Kit Now

5. Conclusion: Take Control Now

The student loan system today is not defined by simple, predictable rules. It is defined by manufactured instability. This instability is the direct result of political gamesmanship using the courts (i.e. the Eighth Circuit blocking the entire SAVE plan) and Congressional mandates (i.e.“One Big Beautiful Bill Act”), to dramatically restrict future repayment options.

If you feel frustrated, understand that advocacy groups describe the use of courts by political interests to achieve legislative goals as “wreaking havoc” on the system and putting the financial stability of millions of families at risk.

But uncertainty is not the same as powerlessness. You now hold the critical blueprint to navigate this storm aided by The Payoff Climb Calculator. Your objective is stability, protection, and preservation of the most generous repayment options available to you before they are legislatively or judicially eliminated.

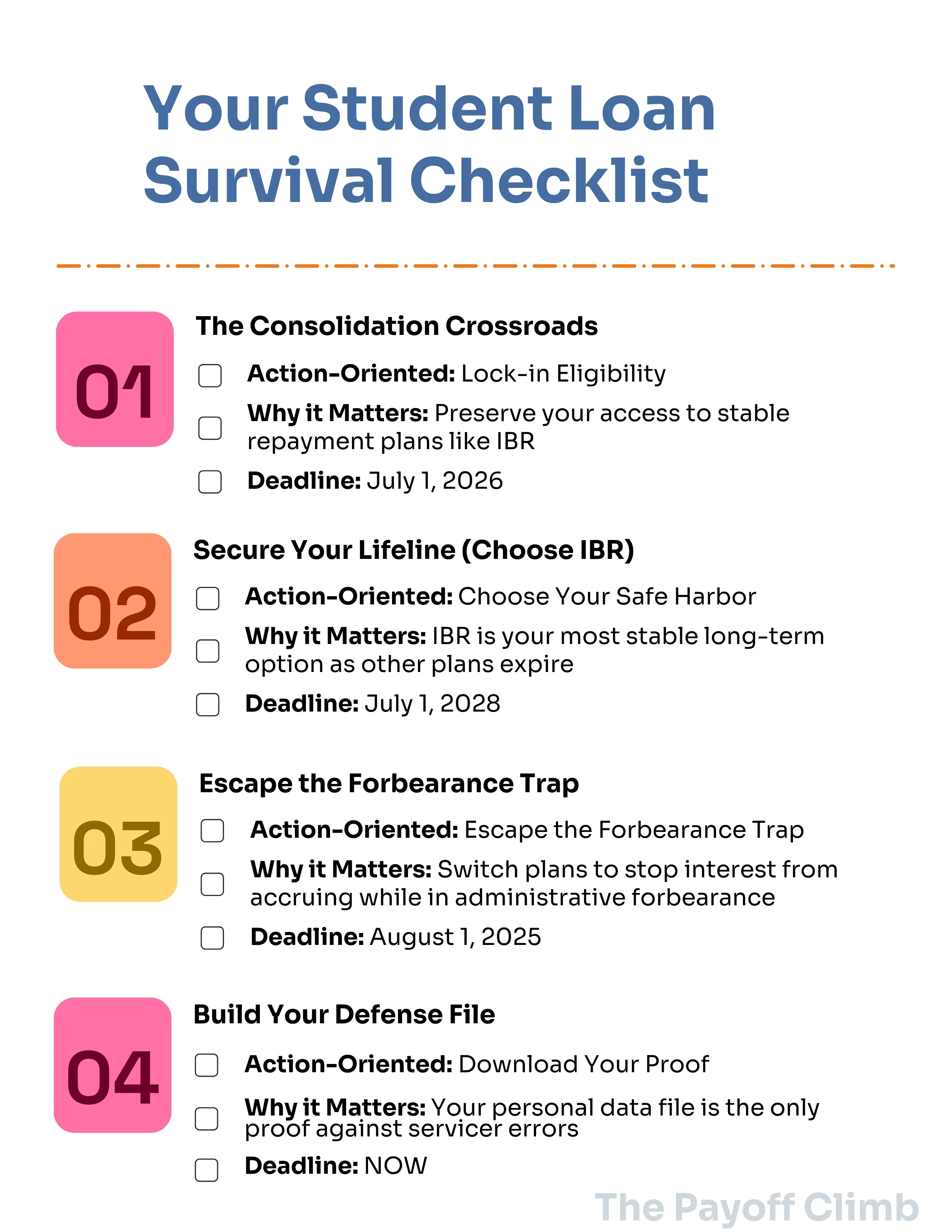

Here is your final, prioritized action list:

Your Urgent Action Plan: Key Steps and Deadlines

| Action Item | Why It Matters | Hard Deadline |

|---|---|---|

| Lock In Eligibility: The Consolidation Crossroads | Consolidating your loans (if needed) before this date ensures you retain access to all grandfathered repayment plans (IBR, PAYE, ICR, Extended, Graduated). If you borrow or consolidate on or after this date, you are permanently limited to the less generous Repayment Assistance Plan (RAP). | July 1, 2026 |

| Secure Your Lifeline: Choose IBR | With SAVE blocked by the 8th Circuit and PAYE/ICR facing the risk of judicial invalidation or expiration in 2028, the congressionally authorized Income-Based Repayment (IBR) plan is your most stable long-term harbor. The elimination of the Partial Financial Hardship (PFH) requirement makes IBR widely accessible. | July 1, 2028 (Sunset for ICR, PAYE, SAVE) |

| Parent PLUS Borrowers: Complete Consolidation | If you have Parent PLUS loans, the double consolidation process is essential to gain eligibility for affordable plans like IBR or PAYE. You must complete this process before the legislative lockout date to protect your access to IBR after 2028. | July 1, 2026 |

| Stop Interest Damage (SAVE Borrowers) | If you are one of the approximately 7-8 million borrowers enrolled in SAVE, the Department of Education has announced that interest charges will resume on August 1, 2025, for those in administrative forbearance. This restart will impose billions in unnecessary costs. If possible, switch to a different, active repayment plan (like IBR) to stop this accrual and resume progress toward forgiveness. | August 1, 2025 |

| Build Your Defense File | Because administrative errors by servicers are common and the system is chaotic, you must immediately download and save your entire loan data history (the .txt file) from StudentAid.gov. This documented proof is your sole defense against future mistakes or litigation-driven interruptions. | NOW |

Get This Entire Survival Guide as a Downloadable E-Book.

This situation is constantly evolving. To help you keep this critical information on hand, we’ve compiled this entire guide, plus additional borrower case studies, into a comprehensive e-book: The Post-SAVE Playbook.

Download it now and reference it whenever you need to check deadlines, compare your options, or plan your next move.

Download The Post-SAVE Playbook E-Book

The situation is complex, but your action plan is clear. Use this checklist to stay on track and protect your financial future. These are the deadlines you cannot afford to miss.

The Map Is Yours

You came to this guide anxious and confused, facing a system where policymakers and courts seem determined to overturn promises and create uncertainty. The fact that over 7 million people were enrolled in the SAVE plan only to have its benefits, like interest non-accrual, stripped away, forcing them into an interest-accruing forbearance, is testament to the political cruelty of the student loan landscape.

But you are no longer a passive passenger.

You have identified the risks, from the tempting lure of refinancing federal loans into the protection-free private loan trap to the reality that your federal loan servicer may mismanage your account due to overwhelming administrative backlogs and system instability.

The system is chaos, but you have a map. Follow these steps.

You have the deadlines. You have the lifeline (IBR). You have the self-defense mechanism (your records). By taking immediate, deliberate action to safeguard your loan status, you are reclaiming control over your financial future, regardless of how aggressively the rules shift around you.

Don’t navigate this environment relying on stale information.

The legal and legislative landscape changes every few months, often without warning. We are committed to providing you with real-time updates on court rulings, new deadlines, and strategic shifts that affect your payment plan or forgiveness timeline.

Take control of your finances with The Payoff Climb calculator and get the latest intel delivered directly to your inbox. Subscribe to our newsletter today for ongoing, authoritative guidance that cuts through the noise and keeps your plan on track.

Frequently Asked Questions About the 2026 Student Loan Changes

Q: I’m currently enrolled in the SAVE plan. What happens to me now?

A: If you are one of the over 7 million borrowers enrolled in SAVE, you have been placed in administrative forbearance while the courts decide the plan’s fate. Starting August 1, 2025, interest resumed on your loans during this forbearance period, and this time does not count toward forgiveness. Your best move is to switch to Income-Based Repayment (IBR) as soon as possible to secure a stable, congressionally authorized plan that courts cannot easily overturn. Note: If you need to consolidate loans first, you must complete consolidation before July 1, 2026 to maintain access to IBR and other legacy plans.

Q: What’s the difference between consolidating before vs. after July 1, 2026?

A: This date is critical. If you consolidate your loans before July 1, 2026, you retain access to all existing repayment plans like IBR, PAYE, and ICR. If you consolidate on or after this date, you’ll be permanently locked into only the new Repayment Assistance Plan (RAP) or the standard plan—losing access to more generous options forever. Think of it as a one-way door that closes on June 30, 2026.

Q: I have Parent PLUS loans. Why is everyone saying I need to act immediately?

A: Parent PLUS loans are excluded from the new RAP plan and are normally restricted to the least affordable repayment option (ICR). The “double consolidation” process is your only path to access better plans like IBR or PAYE, but it takes 4-6 weeks to complete. With the July 1, 2026 deadline approaching, starting now means you’ll finish in time. Waiting could lock you into unaffordable payments permanently.

Q: How do I know if I qualify for “Old IBR” or “New IBR”?

A: It depends on when you took out your first federal student loan. If you had no federal loans before July 1, 2014, you qualify for New IBR (10% of discretionary income, 20-year forgiveness). If you had loans before that date, you’re on Old IBR (15% of discretionary income, 25-year forgiveness). New IBR is the better deal if you qualify. Check your StudentAid.gov account to see your first loan disbursement date.

Q: Is my loan servicer going to tell me about these deadlines and options?

A: Unfortunately, servicers are overwhelmed and may not proactively contact you about these changes. With over 1.6 million unprocessed IDR applications as of April 2025 and massive system changes, errors are common. You are your own best advocate. Download your complete loan history from StudentAid.gov today, mark these deadlines on your calendar, and don’t wait for your servicer to reach out. Assume you need to take action yourself.